Let’s Overcome Your Money Challenges Once and For All

Who Is This For?

If you are…

Aiming For Financial Growth

Relief From Stress

Want Peace Of Mind

Why You Should Finish this Presentation

1. Increase Your Income

2. Stop Overspending Your Money

3. Learn to Invest Your Money for Growth

4. Protect Your Money from Unforeseen Circumstances

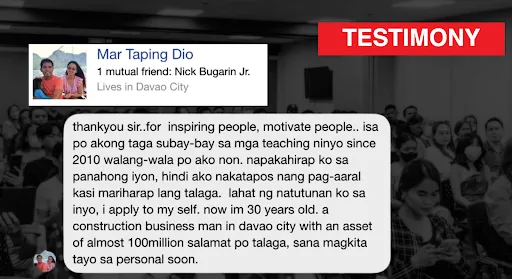

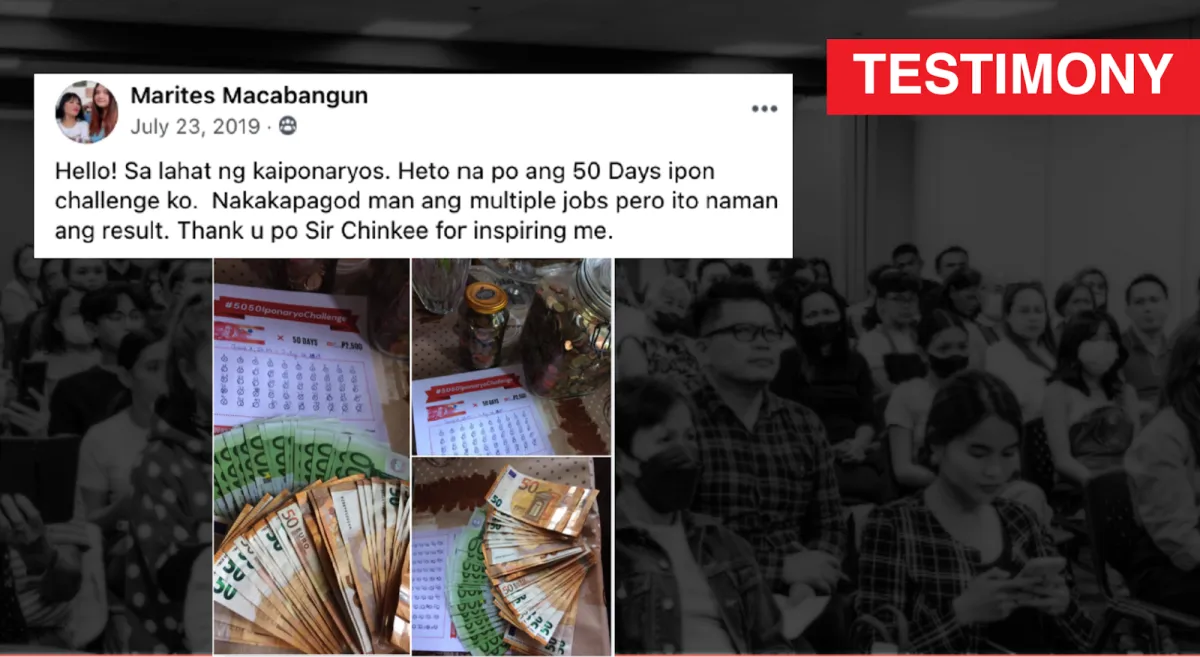

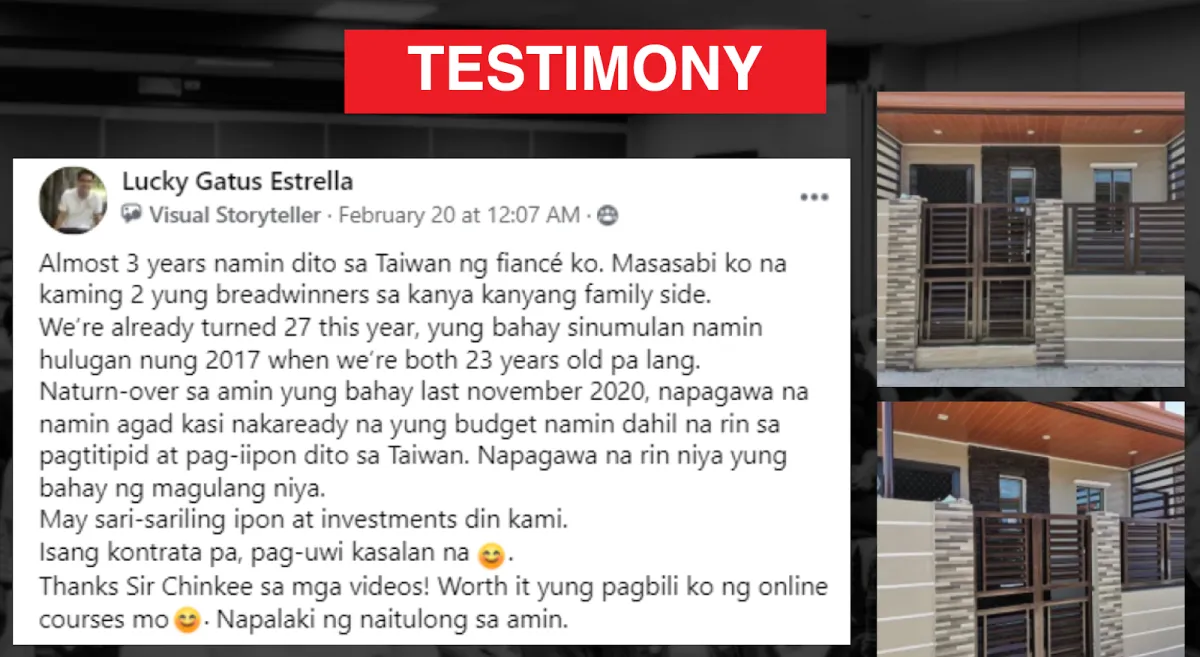

Some People Who Got Results from This Lesson

Who is Chinkee Tan?

Author of best selling book

Radio tv social media personality

“Pambansang Wealth Coach Ng Pilipinas”

Helping thousands of people solve their money problems.

With proven systems and strategies that truly deliver results.

"Let's solve your money challenges once and for all!"

Siguradong isa ito sa pinakamagandang content na mababasa o video na mapapanood niyo tungkol sa paksa na ito, kaya't tapusin mo ito. Hindi nyo pagsisisihan ang bawat minuto na ininvest niyo sa panonood ng video na ito.

So first things first,

Why Invest Your Precious Time? Watching This

1. Do you want to grow your income? STEP BY STEP PROCESS ON HOW TO GROW YOUR INCOME

I'm going to give you a step-by-step process on how you can increase or double your income.

2. I have proven it for myself and the other people we have worked with. PROVEN SYSTEM THAT HELPS THOUSANDS OF PEOPLE

Lahat ng sasabihin ko sa inyo at bawat hakbang na ipapayo ko ay mga bagay na personal ko nang ginagamit. Ibig sabihin, ang lahat ng ito ay batay sa aking sariling karanasan at hindi lang basta kinopya mula sa internet.

Okay, so THIS IS EVERYTHING YOU WILL EVER NEED! to solve your money problems once and for all.

INTRODUCING THE “CHIP METHOD”

Positive Cash Flow

Cash flow is vital for financial freedom as it tracks the movement of money in and out of your accounts.

Positive cash flow occurs when your income exceeds your expenses, facilitating wealth accumulation and financial stability.

It enables you to meet your financial obligations, save for future goals, and capitalize on investment opportunities.

Maintaining a positive cash flow is key to sustaining financial independence and achieving long-term financial success.

When you have a negative cash flow, it means that you are spending more money than you are earning.

6 SIGNS YOU ARE EXPERIENCING NEGATIVE CASH FLOW

Difficulty paying bills and meeting financial obligations

Increased financial stress

Limited ability to save and invest

Accumulating debt

Unable to pursue opportunities

No reserved funds

To create a steady source of cash flow, consider this….

Difficulty paying bills and meeting financial obligations

Increased financial stress

Limited ability to save and invest

Accumulating debt

Unable to pursue opportunities

No reserved funds

Multiple Income Streams

Employment

Sales

Starting a side business

Freelance work

Spare Tire Principle

The Spare Tire Principle in money refers to having a financial backup or emergency fund similar to a spare tire in a vehicle.

Mongo Gulay Mangga Method

Mongo

Short-term income

Daily or frequently.

Gulay

Medium-term income

monthly or regularly.

Manngga

Long-term income

five years or more.

By spreading out income sources in these categories, you will have a steady and stable flow of money.

Broadening your income sources provides stability and a STEADY CASH FLOW.

Each revenue stream contributes to financial security and helps manage financial risks effectively.

How to have this kind of income?

To generate income ideas promptly, consider answering these questions:

What skills or talents do you possess?

How can you transform your talent to profit? interests into profitable ventures?

Be open to start small and scale gradually.

Moving on to the next point, simply increasing your cash flow isn't sufficient. It's not about how much you earn but rather about how much you keep. Do you agree?

Save

Budget

Debt-free

Save

Income - Savings = Expense

The formula suggests that you should prioritize saving a portion of your income before allocating the rest for expenses. By subtracting your savings from your income first, you ensure that you have a plan to set aside money for your future financial goals, thereby promoting financial stability and security.

Budget

Expense Management

Keep track of your expenses and create a budget to ensure that your spending aligns with your income. Identify areas where you can cut costs and allocate more money towards savings and investments.

Bawas Dagdag Method

Cut unnecessary expenses. and increase your income. Money not spent is money additionally earned.

Debt

Get out of bad debt

get rid of debts that do not make you money.

Get into good debt

use debts that can help you make more money.

UITF

Stock

Mutual Fund

MP2

Property

Crypto

Arts

The moment you stop working, you stop earning, but we don’t stop spending.

EVEN IF YOU STOP WORKING, YOUR INCOME WILL NEVER STOP

2 Types of Cash Flow

Active Income

When you work, you get paid

Passive Income

When you stop working, you still get paid

The Goal:

Create Passive Income

If you have dividend-paying stocks, rental properties, bonds, or assets. These investments can provide regular cash flow without requiring active involvement on your part.

Warning!

Rule #1

NEVER INVEST IN SOMETHING YOU DON’T UNDERSTAND NO MATTER HOW PROFITABLE IT MAY BE

Rule #2

NEVER INVEST THE MONEY YOU CANNOT AFFORD TO LOSE

Financial Planning

Health

Life

Non-Life

Estate Planning

Do you know anyone who got COVID? Their hospital bills could be hundreds of thousands or even millions. Without protection, you could lose your savings, investments, and ability to earn, putting you back at square one.

Establish an emergency fund to cover unexpected expenses or temporary periods of reduced income. Having a financial safety net can help you avoid cash flow disruptions during challenging times.

By implementing these strategies, you can create a consistent and reliable source of cash flow that supports your journey towards financial freedom.

Prevention is better than cure!

Build Emergency Funds

3-6 Months of Expenses

By implementing these strategies

YOU CAN CREATE CONSISTENT AND RELIABLE SOURCE OF CASH FLOW

Now You Know!

This is everything that you would ever need to know to SOLVE YOUR MONEY PROBLEMS ONCE AND FOR ALL.

Just KNOWING ISN'T ENOUGH. Why?

Because IT'S NOT ABOUT HOW MUCH YOU KNOW, BUT HOW MUCH YOU APPLY! Do you agree?

I apply CHIP METHOD for my personal finance that I've applied for a lot of my clients. So if you're serious about solving your money problems once and for all and if you like what I just told you, I HAVE GOOD NEWS! for you.

What if I can help you apply by coaching and guiding you on a monthly basis to make this happen.

Would you be interested?

If you agree, you will get the chance to gain ACCESS to...

What You’ll Experience

Pre-recorded Videos: Spend just 10 to 15 minutes daily anytime, anywhere at your convenient time and location.

Proven Roadmap: Just follow our step-by-step guide.

Group Coaching Sessions: Check in once a month.

Connect with like-minded people: Share and learn together; you're never alone.

Watch Pre-recorded Videos: Spend just 10 to 15 minutes daily anytime, anywhere

Proven Roadmap: Just follow our step-by-step guide.

Group Coaching once a month

Connect with like-minded people

If you want the best for you and your family,

We are best at helping people solve their money problems.

Narito na lahat ng aking maibabahagi. Sana'y nagustuhan mo. Don’t hesitate to share this information to your friends and loved ones, gamitin ito sa iyong sarili, at makamit ang mga resultang nararapat sa iyo. If you want the best for you and your family, you deserve the best team and we are best in this. we are best at helping people solve their money problems.

This is what we've been doing for 15 years.

Copyright © 2024 · chinkeetan.com · TEAM POSITIVE INC.